This documentation will guide you through the features, setup, and usage of the Income and Expenses Tracking Excel Template. Created specifically for families, this template helps track income, expenses, and savings. It includes several powerful, easy-to-use sheets to ensure you stay on top of your finances and have a clear picture of your family’s financial health.

Template Sheets Overview

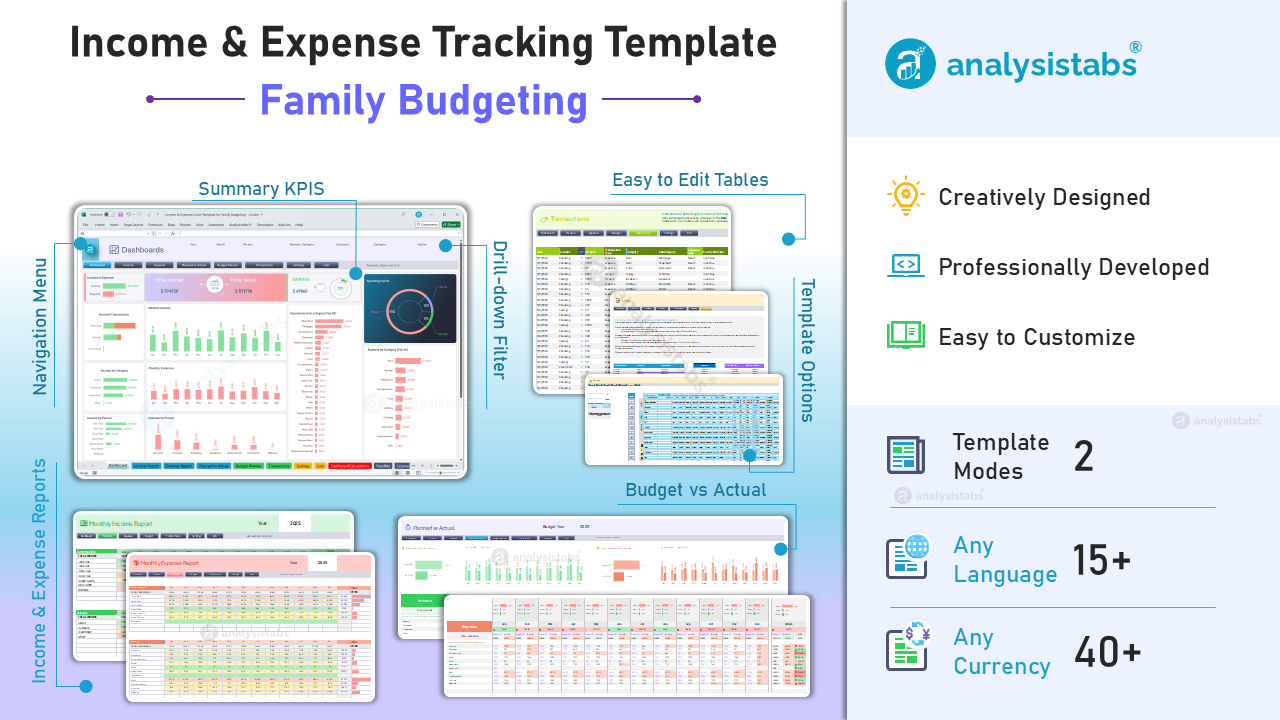

📈 Dashboards (Data Visualization Sheet)

The Dashboards sheet is a comprehensive data visualization tool designed to give you an overview of your finances. This sheet displays key metrics such as Total Income, Total Expenses, and Savings. It allows you to easily check income and expenses by person, category, or month and provides detailed visualizations to monitor your financial health.

Key Features:

- Income and Expense by Person: See how much each family member is contributing to both income and expenses.

- Income and Expense by Category: Understand where your money is coming from and where it’s going.

- Spending Breakdown: Visualize your expenses by Expense Type (Needs, Wants, Savings).

- Filters: Use Drop-down list to filter the dashboard by Year, Month, Family Member, Family Category (Parent, Child, Grandparent), Category, Expense Habits, and Accounts.

💵 Monthly Income Report (Data Visualization Sheet)

The Monthly Income Report helps you visualize your family’s income patterns. This sheet provides HeatMaps to show income distribution by person and category over the year, making it easier to spot trends and areas of concern.

Key Features:

- Income HeatMap by Person: See income distribution across family members by month for the selected year.

- Income HeatMap by Category: Visualize income by category to understand which sources are contributing the most to your household’s income.

💸 Monthly Expense Report (Data Visualization Sheet)

The Monthly Expense Report allows you to track your family’s expenses visually. It includes HeatMaps to show expenses by person and category over the year, helping you understand where your money is being spent and identify potential areas for savings.

Key Features:

- Expense HeatMap by Person: Track how much each family member is spending each month throughout the year.

- Expense HeatMap by Category: Get insights into how much you are spending in various categories like Rent, Food, Utilities, etc.

💰 Planned vs Actual (Data Visualization Sheet)

The Planned vs Actual sheet helps you monitor and compare your financial performance. It automatically visualizes the differences between planned and actual income and expenses, giving you a clear overview of how well you are sticking to your budget. The chart-based data allows you to quickly identify trends and discrepancies.

Key Features:

- Visual Comparison: View your planned vs actual income and expenses with easy-to-read charts for quick analysis.

- Monthly and Yearly Comparison: Track your performance over both short and long periods to adjust your financial plans accordingly.

💰 Budget Planner (Data Visualization and Data Entry Sheet)

The Budget Planner sheet provides an interactive space where you can enter your planned income and expenses by category for each month. This section calculates actual figures from the Transactions sheet, helping you assess how closely your real-life spending aligns with your budget, while offering a data-driven view of your financial planning.

Key Features:

- Planned vs Actual Income: Enter planned income for each category, with actual income automatically calculated from transactions.

- Planned vs Actual Expenses: Enter planned expenses by category, with actual expenses updated from your transactions.

- Monthly and Yearly Comparison: Easily compare your planned and actual figures, giving you a clear overview of your financial progress.

🏷️ Transactions (Data Entry Sheet)

The Transactions sheet allows you to record every financial transaction, whether it's income or an expense. This sheet helps maintain a detailed log of every transaction, including the date, amount, category, subcategory, and family member responsible for the transaction.

Key Features:

- Transaction Log: Record all income and expense transactions by date, amount, category, and subcategory.

- Family Member Assignment: Tag each transaction to a specific family member.

- Account Tracking: Record transactions across various accounts such as Checking, Savings, and Credit Card.

- Expense Type: Specify whether the transaction is categorized as Needs, Wants, or Savings (only if the transaction type is Expense).

- Calculated Fields: Fields like Income, Expense, Member Category, Year, Month, and Validation are automatically calculated for data visualization.

🧮 Calculations (Back-End Calculations Sheet)

The Calculations sheet contains all the formulas needed to calculate total income, expenses, and savings. It is the backend of the template, supporting all data visualization and reporting functions. This sheet ensures that calculations are accurate and up-to-date, allowing you to analyze your financial situation with ease.

Key Features:

- Automated Calculations: Calculates total income, expenses, and savings based on input data from other sheets.

- Balances and Summaries: Helps you generate year-end summaries and balances to better understand your financial position.

⚙️ Settings (Setup and Data Entry Sheet)

The Settings sheet allows you to customize the template to suit your needs. You can set the currency (choose from 45+ currencies) and the language (select from 15+ predefined languages or customize your own). You can also toggle between Default Mode and Edit Mode, which highlights editable cells in yellow to make data entry easier.

Key Features:

- Currency and Language Settings: Set your preferred currency and language.

- Template Mode: Switch between Default Mode (viewing) and Edit Mode (data entry).

- Editable Cells: In Edit Mode, editable cells are highlighted in yellow for easy identification.

📝 Lists (Data Entry Sheet)

The Lists sheet allows you to define your own income and expense categories and subcategories. You can also list family members and assign them to categories such as Parent, Child, or Grandparent. Additionally, you can maintain a list of accounts (Checking, Savings, Credit Card, etc.) for better financial tracking.

Key Features:

- Income and Expense Categories: Create and manage your income and expense categories and subcategories.

- Family Members: Enter family member names and assign them to appropriate categories (e.g., Parent, Child, Grandparent).

- Accounts: List the accounts used for transactions (e.g., Checking, Savings, Credit Card).

How to Use the Template

Step 1: Initial Setup

Settings Sheet: Set Up Your Preferences

-

- Set Currency: In the Settings sheet, choose your preferred currency symbol (e.g., $, €, £). If your currency is not in the list, you can add a custom one.

- Set Language: Choose your preferred language from 15+ predefined options. If your language is not in the list, you can enter custom labels and translations.

- Template Mode: Select Default Mode (for viewing) or Edit Mode (for entering data).

- In Edit Mode, all editable cells are highlighted in yellow, making it easy to identify where to enter data.

Lists Sheet: Organize Categories and Subcategories

-

- Create Income Categories: Start by listing all your Income categories (e.g., Salary, Business, Investment, Other) in Income Categories Table as Column Headings. Then, add their corresponding subcategories (e.g., Salary → Full-time, Part-time) in each Column.

- Similarly, Create Expense Categories: After setting up the Income categories, list all your Expense categories (e.g., Clothing, Education, Healthcare) in Expense Categories Table. Then, add subcategories under each (e.g., Clothing → Coat, Jacket, Shirt).

- List Family Members: Add all family member names and categorize them (e.g., Parent, Child, Grandparent).

- List Accounts: Add all your accounts (e.g., Checking, Savings, Credit Card).

Step 2: Log All Your Daily Transactions

Transactions Sheet: Record Transactions

-

- Enter Transaction Details: Record every transaction as it occurs in the Transactions sheet.

- Date: Enter the date of the transaction.

- Amount: Enter the amount for income or expense.

- Transaction Type: Choose whether the transaction is Income or Expense.

- Category & Subcategory: Assign a category and subcategory to each transaction.

- Family Member: Tag the transaction to the responsible family member.

- Account: Choose the account (e.g., Checking, Savings, Credit Card).

- Description (Optional): Add any additional details or notes for clarity.

- Expense Type: For Expense transactions, specify whether it is a Need, Want, or Savings.

- Calculated Fields: Fields such as Income, Expense, Member Category, Year, Month, and Validation are automatically calculated.

- Enter Transaction Details: Record every transaction as it occurs in the Transactions sheet.

Step 3: Plan Your Monthly Budgets

Budget Planner Sheet: Plan Monthly Budgets

-

- Enter Planned Income: Enter the Planned Income for each category for each month. This represents your budgeted income for the month.

- Enter Planned Expenses: Enter the Planned Expenses for each category for each month. This represents your budgeted spending for the month.

Step 4: Analyze Your Income and Expenses

Monthly Income Report Sheet: Analyze Income

-

- Income HeatMap by Person: View a heatmap showing income by person for each month in the selected year.

- Income HeatMap by Category: See the income by category (e.g., Salary, Business) for the selected year.

- Color-Coded Heatmap: Higher incomes will be shown in green cells, and lower incomes will be in red cells, helping you quickly understand income trends.

Monthly Expense Report Sheet: Analyze Expenses

-

- Expense HeatMap by Person: View a heatmap showing expenses by person for each month in the selected year.

- Expense HeatMap by Category: See the expenses by category (e.g., Rent, Food, Utilities) for the selected year.

- Color-Coded Heatmap: Higher expenses are highlighted in red, and lower expenses are in green, helping you spot areas where you might be overspending.

Review Your Financial Health: Dashboards Sheet

-

- Overview of Financial Health: Use the Dashboards sheet to quickly view your total income, total expenses, and savings.

- Drill-Down with Filter: Use Drop-down lists above the menu to filter data by Year, Month, Family Member, Family Category (Parent, Child, Grandparent), Category, Expense Type (Needs, Wants, Savings), and Accounts. This allows you to analyze specific aspects of your finances in more detail.

Planned vs Actual Sheet: Track Your Budget

-

- Compare Planned vs Actual: Regularly compare your planned income and expenses against your actual income and expenses.

- Review Monthly and Yearly: The sheet will help you track if you are staying within your planned budget and allow you to make adjustments for future months.

Step 5: Analyze and Adjust Your Budget

- Adjust Your Budget: Based on your analysis of income and expenses, use the insights from the Dashboards and Planned vs Actual sheets to adjust your budget in the Budget Planner Sheet.

- Review Regularly: Keep monitoring your transactions, income, and expenses to ensure you’re meeting your financial goals.

- Use the Calculations Sheet: The Calculations sheet will help you generate automatic totals and summaries, ensuring your data is accurate and up-to-date.

By following these steps, you can effectively set up, track, and manage your finances with the Income and Expenses Tracking Excel Template. It provides you with the necessary tools to make informed decisions, stay on budget, and achieve your financial goals.

FAQs for Income and Expenses Tracking Excel Template

Can I add more categories?

Yes, you can add more categories. To do so, unprotect the sheet from the Review Tab. Then, right-click on one of the column headers in the Categories Table, and click Insert → Table Column Left or Table Column Right to add a new category.

How do I add more rows to the Transactions Table?

The Transactions Table will automatically adjust when you enter data in the last row of the table. Alternatively, you can manually add new rows by right-clicking on any row and selecting Insert → Insert Rows Above or Insert Rows Below.

Can I rename the column names in the Transactions Table?

No, do not rename the column names in the Transactions Table. Renaming them will affect the calculations and data flow within the template.

What are the gray columns in the Transactions Table?

The gray columns (from Income to InExID) in the Transactions Table are calculated fields. These columns are used for data filtering and validation purposes. Do not modify these columns as it will disrupt the calculations and integrity of the data.

What is the purpose of the "Income and Expenses Tracking Excel Template"?

The template is designed to help families track their income, expenses, and savings. It provides a comprehensive toolset to manage monthly budgets, monitor financial health, and compare planned versus actual spending.

How do I set up the template for the first time?

- Step 1: Initial Setup

- Go to the Settings Sheet and select your preferred currency and language.

- Set the Template Mode to either Default (viewing) or Edit Mode (data entry), where editable cells are highlighted in yellow.

- Step 2: Organize Categories

- Create Income and Expense categories and subcategories in the Lists Sheet.

- Add family members and assign them to categories (e.g., Parent, Child, Grandparent).

How do I record my financial transactions?

- Navigate to the Transactions Sheet and enter details for each transaction, including the date, amount, category, subcategory, and the family member responsible. You can also choose the account used (e.g., Checking, Savings, Credit Card).

How do I plan my monthly budget?

In the Budget Planner Sheet, enter your Planned Income and Planned Expenses for each category and month. This will help you set your financial goals for the month and track them against actual results.

What kind of visual reports does the template provide?

- Dashboards Sheet: Provides a high-level overview of your financial health, including Total Income, Total Expenses, and Savings. It also allows you to filter by year, month, family member, category, and more.

- Monthly Income and Expense Reports: These sheets feature HeatMaps to help you analyze income and expenses by person and category across the year.

- Planned vs Actual Sheet: Allows you to compare your Planned Income and Expenses with actual figures, using visual charts for quick analysis.

How can I compare my planned income and expenses with actuals?

In the Planned vs Actual Sheet, you can compare your planned and actual income and expenses for each month. This sheet includes charts for easy visual comparison and helps you track any discrepancies.

How do I adjust my budget if my spending is different from the plan?

- Use the insights from the Dashboards and Planned vs Actual sheets to analyze your income and expenses.

- Based on this analysis, adjust your Planned Income and Planned Expenses in the Budget Planner Sheet to reflect your actual spending patterns.

Can I customize the categories and family members?

Yes, you can define and customize your income and expense categories, as well as add family members in the Lists Sheet. This allows you to personalize the template according to your family’s needs.

How do I track specific family members' income and expenses?

The Dashboards Sheet and Transactions Sheet allow you to assign transactions to specific family members. You can easily track each member’s income and expenses by using the filters and heatmaps in the Dashboards and Monthly Reports.

What if I need to change the currency or language?

You can change the currency and language settings in the Settings Sheet. The template supports multiple currencies and languages, and you can even add custom ones if needed.

What are the "Needs", "Wants", and "Savings" categories?

These are categories to classify your expenses:

- Needs: Essential expenses like food, rent, and utilities.

- Wants: Non-essential expenses like entertainment, dining out, etc.

- Savings: Money set aside for future goals or emergencies.

How are the calculations made in the template?

All calculations are handled automatically in the Calculations Sheet. This includes total income, total expenses, savings, and summaries. The data in other sheets, such as Transactions and Budget Planner, feed into this sheet for accurate calculations.

How do I use the Filters in the Dashboards Sheet?

Filters in the Dashboard sheet allow you to filter data by categories such as Year, Month, Family Member, Category, and Expense Type. This lets you drill down into specific areas of your finances for a more detailed analysis.

Can I track multiple accounts for transactions?

Yes, you can track transactions across multiple accounts (e.g., Checking, Savings, Credit Card) in the Transactions Sheet.

How often should I review and update my budget?

It’s recommended to review your monthly income and expenses regularly. Use the insights from the Planned vs Actual Sheet to adjust your budget for future months if necessary.