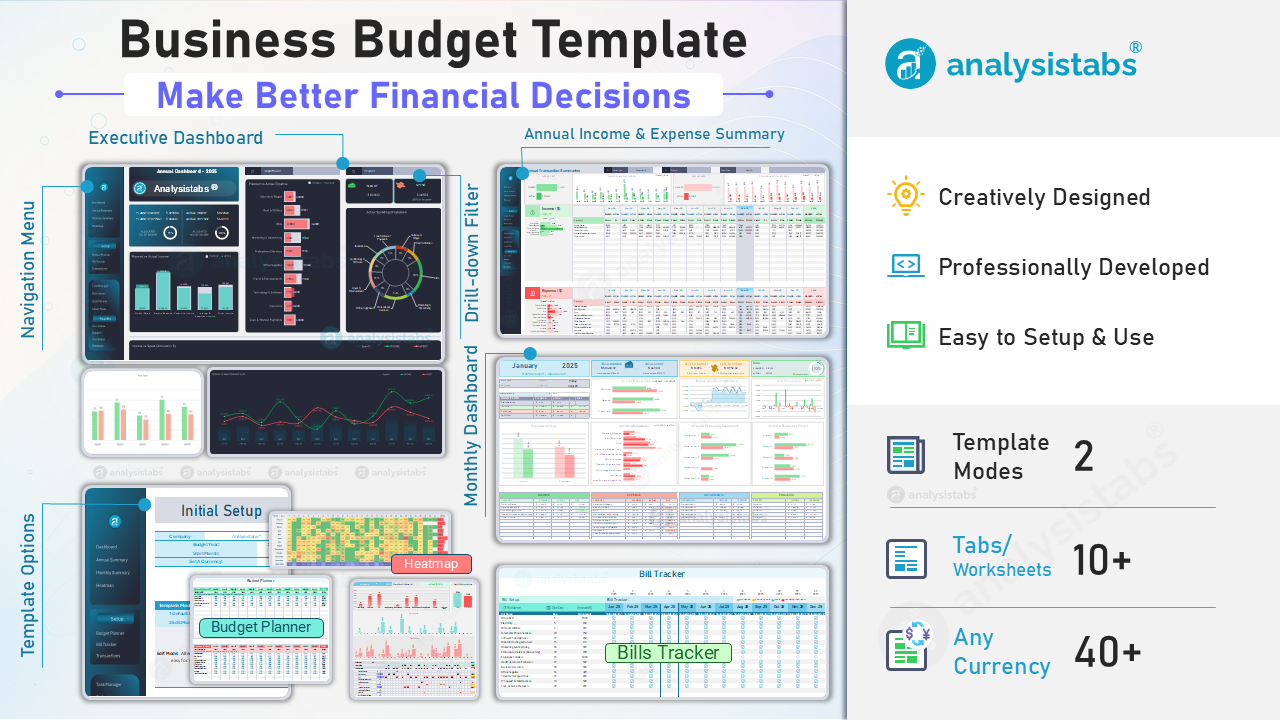

Business Budget Excel Template

The Business Budget Template is an all-in-one Excel solution to plan, track, and analyze your business finances. Fully customizable and easy to use, it includes budgeting, bill tracking, transactions, and dashboards to keep your business financially organized all year.

Workbook Includes 10+ Tabs (Sheets):

Original price was: $ 149.$ 99Current price is: $ 99.

34% Off

Welcome to Analysistabs

Business Budget Excel Template

Take Full Control of Your Business Finances — All Year Round!

Business Budget Excel Template

Why Choose Our Business Budget Tracking Template?

Business Budget Excel Template – Key Features

Effortlessly Manage Your Business Finances

Our Simple Business Budget Template empowers you to plan, track, and analyze your business income, expenses, bills, and goals all in one place. Make smarter financial decisions and stay financially organized every day!

Log Daily Business Income and Expenses with Ease

Automatically Track Recurring Bills by Month

View Profit Goals, Cumulative Trends & KPI Summaries

Gain Clarity on Spending, Cashflow, and Profitability

What’s Inside the Simple Business Budget Template?

Our Simple Business Budget Template is packed with powerful tools to help you plan, track, and analyze your business finances with confidence. Here’s what you’ll find inside:

Business Budget Template – Dashboard Tab

Dynamic Financial Dashboards: Real-Time Business Insights.

The Dashboard sheet offers a powerful, real-time overview of your business finances. With visually engaging charts and key performance indicators (KPIs), it allows you to monitor income, expenses, profit/loss, and financial trends at a glance—helping you make smarter, data-driven business decisions.

- Comprehensive Dashboards: Gain instant visibility into your business performance with dynamic charts and metrics that auto-update as you enter data.

- Income & Expense Insights: View monthly trends of income and expenses across all categories, departments, and projects.

- Planned vs Actual Comparison: Quickly identify budget deviations with side-by-side planned vs actual visuals.

- Spending Breakdown Charts: Understand how your budget is distributed with pie charts, bar graphs, and category-based visuals.

- Department & Project Filters: Filter your entire dashboard by department or project to focus on specific business units or initiatives.

- Heatmap View: Visualize daily expenses across each month to spot high-spend days and irregularities in cash flow.

- Notes & To-Do Section: Document key observations, tasks, or reminders directly within the dashboard for quick access and action.

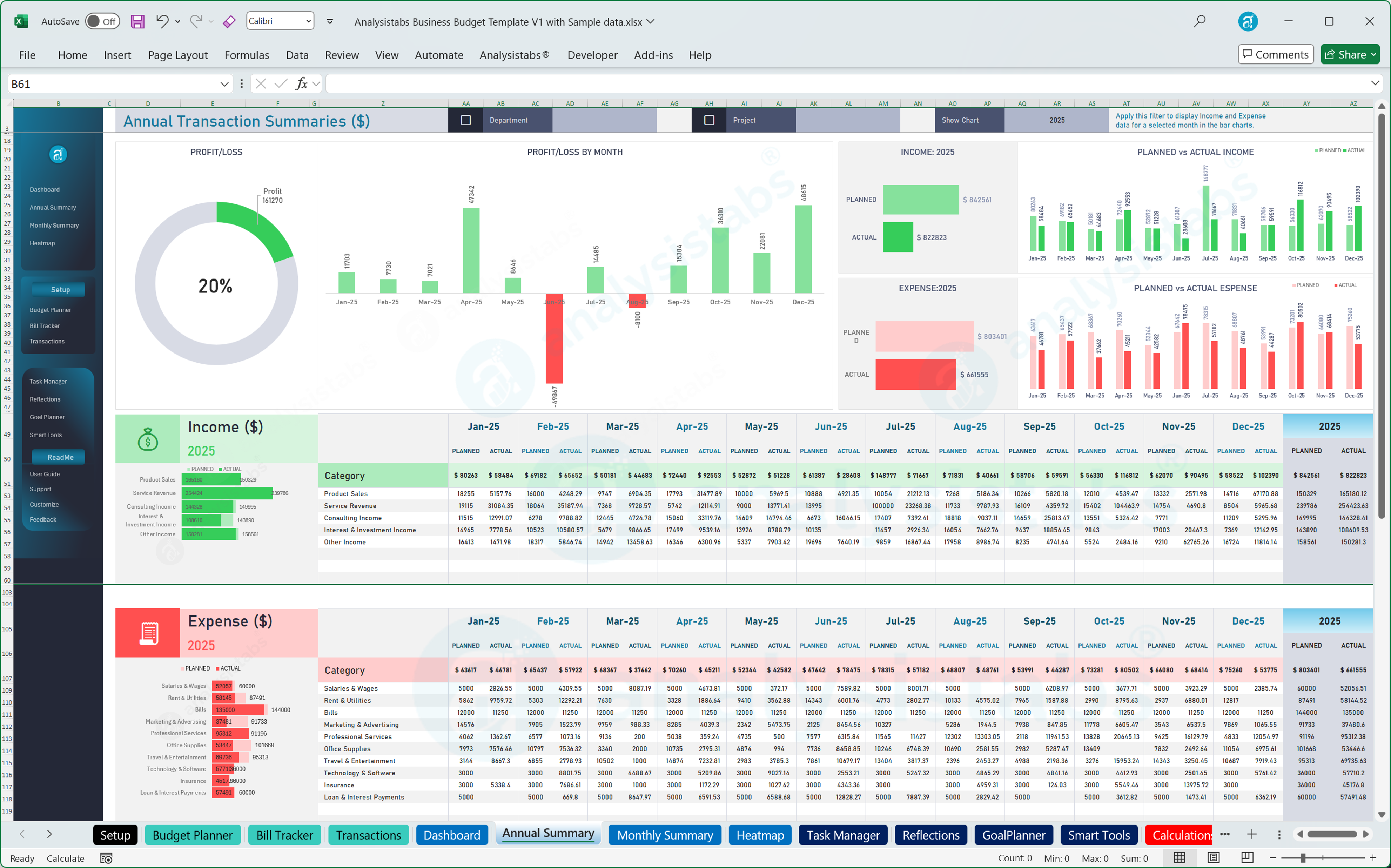

Business Budget Template – Annual Summary Tab

Yearly Financial Overview: Compare, Analyze & Optimize.

The Annual Summary sheet offers a high-level view of your entire financial year. Track and compare your Planned vs Actual income and expenses, identify trends, and analyze performance across all categories. Built-in filters allow you to drill down by department or project for deeper insights.

- Planned vs Actual Comparison: Visualize how closely your actual financial results align with your original budget across all categories and months.

- Category-Based Summary Tables: Structured tables break down monthly performance for each income and expense category, helping you analyze patterns over time.

- Visual Summary Charts: Bar charts and column visuals highlight monthly totals and category-level performance for easy year-round comparison.

- Income & Expense Breakdown: Get clarity on where your money came from and where it went—across all business segments.

- Department & Project Filters: Use top-level filters to narrow down your view and focus on specific departments or projects.

- Auto-Calculated Totals: All figures update automatically based on your budget and transaction entries—no manual calculations required.

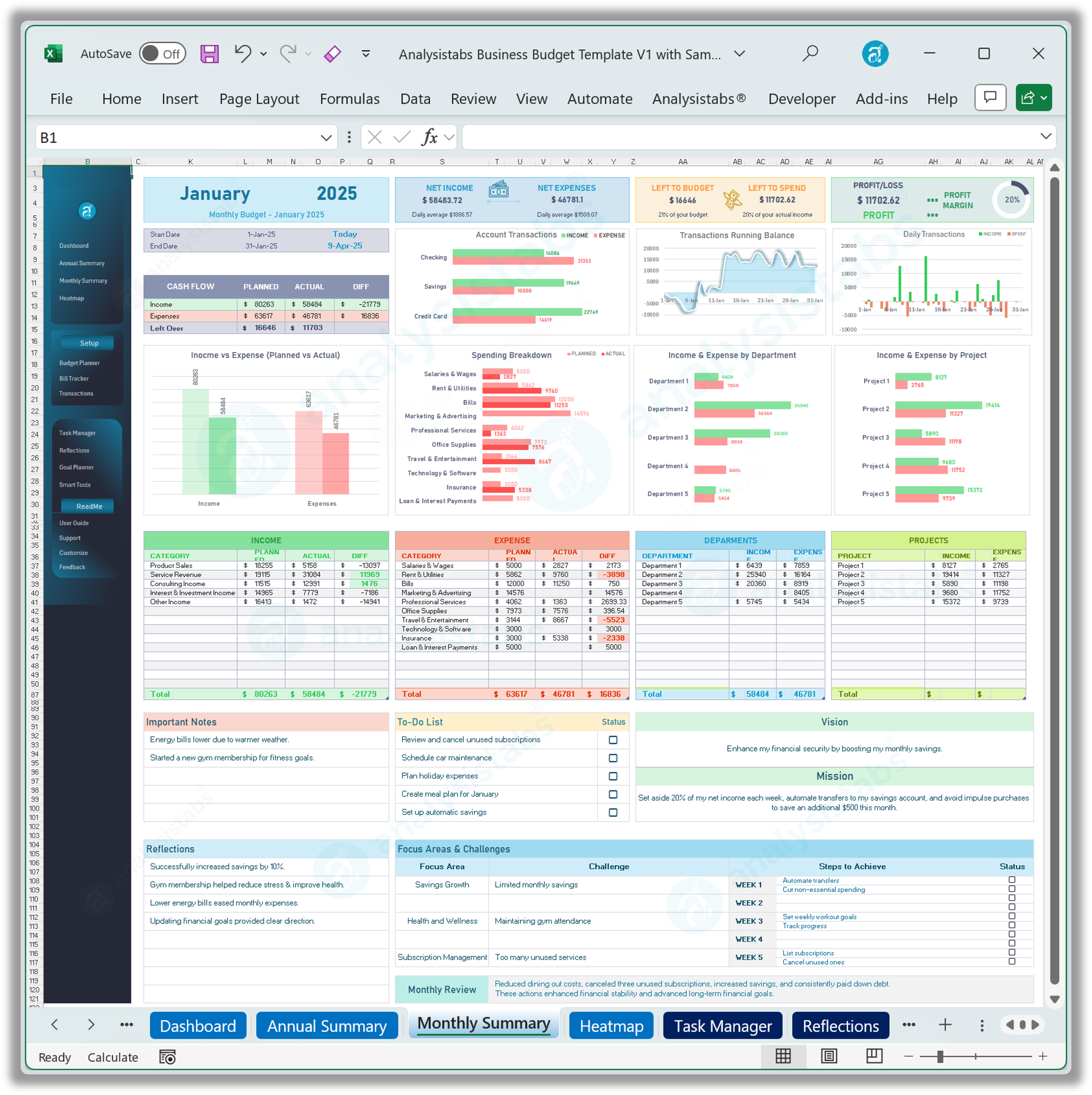

Business Budget Template – Monthly Dashboard Tab

Zoom Into Your Monthly Performance: Detailed Insights at a Glance.

The Monthly Summary sheet provides a focused view of your finances for any selected month. With interactive KPIs, charts, tables, and reflection tools, it helps you understand your income, expenses, cash flow, and financial behavior—empowering you to make informed decisions every month.

- Month Selector: Choose any month to view real-time summaries and dynamic visuals based on that month’s transactions and budgets.

- Key Monthly KPIs: Instantly see metrics like Net Income, Net Expenses, Profit/Loss, Budget Left, and Spending Balance.

- Cash Flow & Transaction Charts: Visualize running balances, daily spending patterns, and compare income vs expense using area, line, and column charts.

- Spending Breakdown: View category-wise pie charts and bar graphs to see where your money went during the month.

- Department & Project Breakdown: Track income and expense distribution by department and project for better operational insights.

- Detailed Summary Tables: Automatically generated income, expense, department, and project summaries for the selected month.

- Notes & Reflection Section: Includes space to record: Important Notes, To-Do Lists, Vision & Focus Areas, Challenges & Monthly Review.

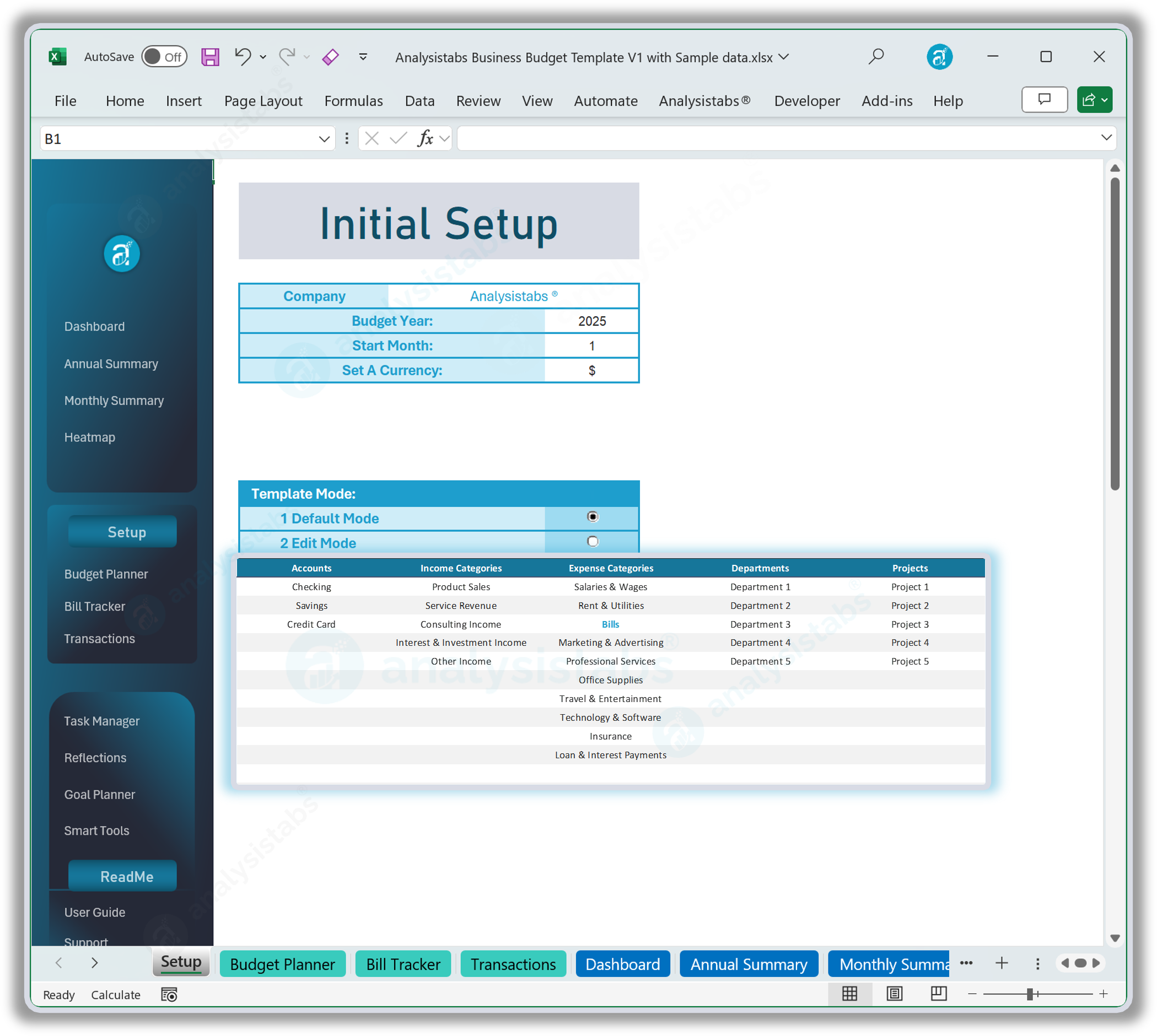

Business Budget Template – Setup Tab

Customize Once, Use All Year: Your Template Starts Here.

The Setup sheet is the foundation of your budget template. Define your fiscal year, start month, currency, and master categories to personalize the entire system. With smart edit modes and dropdown-driven settings, it ensures the rest of the template functions smoothly and accurately.

- Budget Year & Start Month: Choose any calendar or fiscal year and define your starting month (e.g., Jan, Apr, Jul) for flexible planning.

- Currency Selector: Pick from 40+ predefined currencies or enter your own to match your business region or preference.

- Master Category Setup: Easily define: Accounts, Income Categories, Expense Categories, Departments, Projects. These drive dropdowns and tracking across all sheets.

- Template Mode Options: Toggle between:

- Default Mode for secure viewing

- Edit Mode to highlight all editable cells in yellow

- Centralized Configuration: Changes made here dynamically flow through the entire template—saving time and ensuring data consistency everywhere.

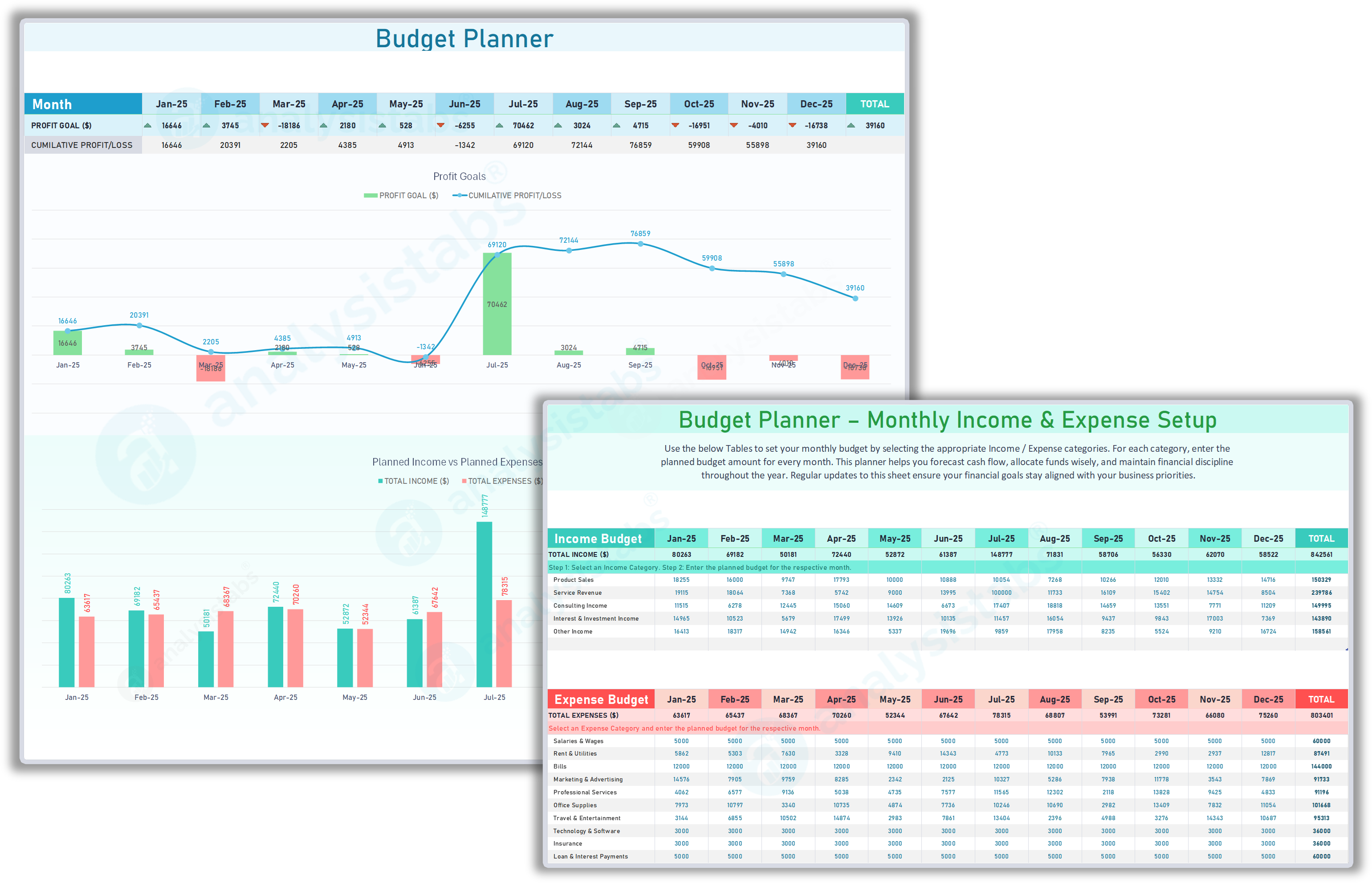

Business Budget Template – Budget Planner Tab

Plan Ahead with Confidence: Set Monthly Budgets and Visualize Profit Goals.

The Budget Planner sheet is where your financial strategy begins. Set your planned income and expenses for each month by category, visualize your profit goals instantly, and adjust your budget based on interactive charts. It’s your financial blueprint for the year.

- Dynamic Monthly Headers: Automatically adapts to your selected budget year and start month (e.g., January or April fiscal year start).

- Income & Expense Budget Tables: Enter planned amounts by category and month for both income and expenses—clearly structured for easy planning.

- Profit Goal Chart: Visual line + column chart shows planned monthly profits and cumulative profit/loss to help guide strategic decisions.

- Income vs Expense Chart: Compare total planned income and expenses side-by-side with a simple, intuitive column chart.

- Instant Feedback for Adjustments: Quickly spot budget imbalances or surpluses and refine your monthly plans to align with business targets.

- Supports Strategic Budgeting: Use as a high-level guide to control spending, maximize profit margins, and stay financially prepared throughout the year.

Business Budget Template – Bill Tracker Tab

Automate Recurring Bill Tracking with Smart Status Indicators.

The Bill Tracker sheet helps you manage recurring business bills across the year. Enter each bill once, and the tracker automatically updates monthly statuses based on your transaction data. Instantly see which bills are paid, pending, or overdue—without manual calculations.

- Bill Setup Table: Log each bill’s Name, Due Day (1–31), and Fixed Monthly Amount just once.

- Auto-Updating Monthly Status Grid: The system automatically checks your transactions and marks each bill with a visual status icon every month.

- Status Icons: ✅ Paid, 🌓 Partially Paid, 🕒 Scheduled, 🚫 Pending / Overdue

- Linked with Transactions Sheet: Bill status updates are driven by actual entries from the Transactions Sheet—no double data entry required.

- Category Dependency: To enable this feature, ensure that ‘Bills’ is added as an Expense Category in the Setup sheet.

- Year-Round Monitoring: Visually track your business obligations across all 12 months at a glance, reducing the risk of missed payments.

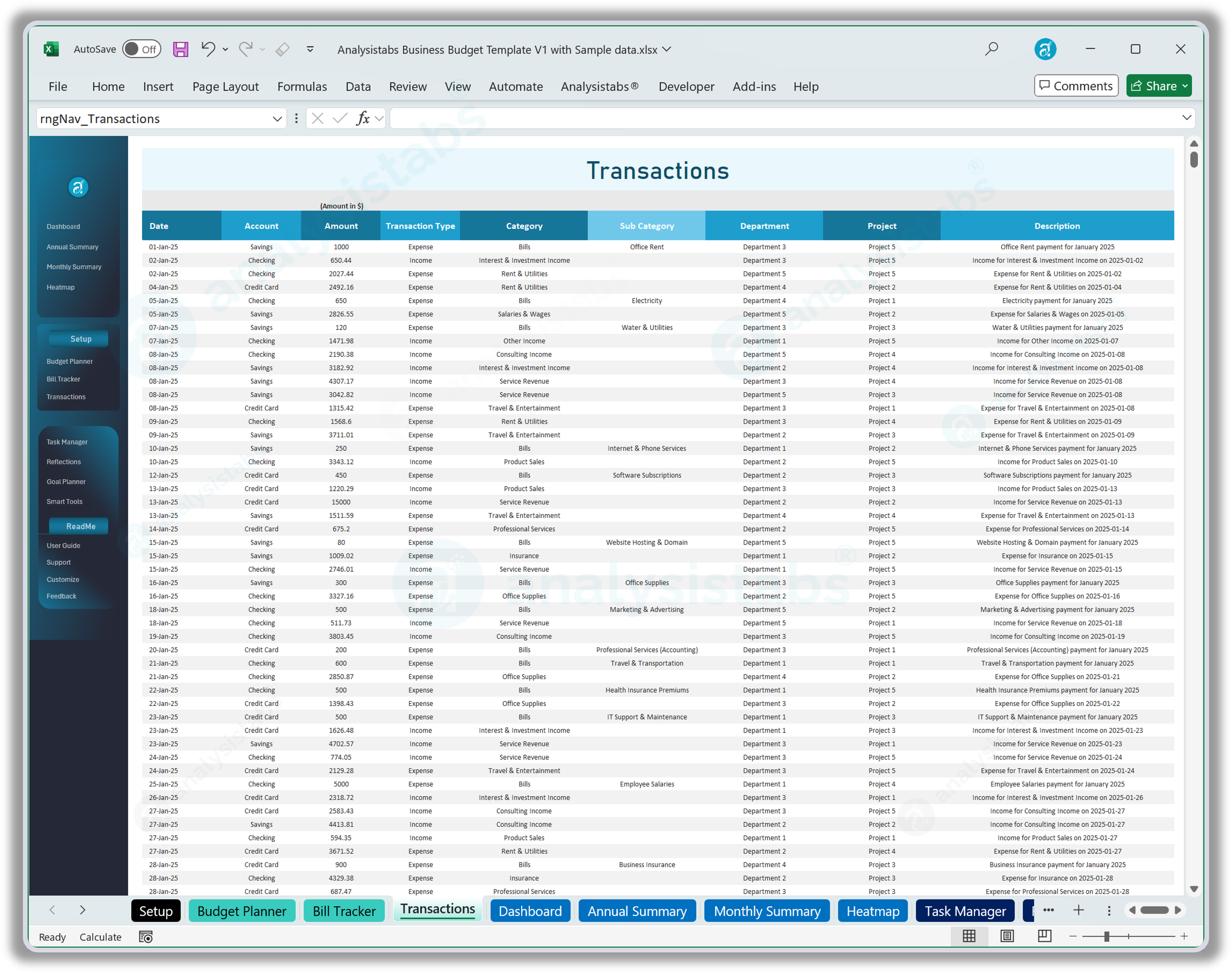

Business Budget Template – Transactions Tab

One Place for Everything: Log All Income & Expenses with Full Detail.

The Transactions sheet is the backbone of your financial system. Every chart, summary, bill status, and report in the template is powered by the data you enter here. Keep all income and expense records centralized, categorized, and fully traceable.

- Centralized Data Entry: Log all financial activity—both income and expenses—in a single, well-structured table.

- Essential Fields for Clarity: Each record includes:

- Date, Account, Amount, Transaction Type (Income or Expense)

- Category & Subcategory, Department & Project, Description

- Supports Bills & Budgeting: Select “Bills” as the category to link to your Bill Tracker. Planned vs Actual comparisons update automatically.

- Drives Dashboards & Reports: Feeds real-time data to:

- Dashboard, Annual Summary, Monthly Summary, Heatmap, Bill Tracker

- Consistent Categorization: All category fields use dropdowns linked to your Setup sheet—ensuring clean, reliable, and consistent data.

- Full Transparency: Easily audit or filter any transaction using Excel’s built-in tools. Perfect for monthly reviews or end-of-year reporting.

Comprehensive Planning Tabs

Useful Budget Management Tools for Effective Financial Planning.

Elevate your budgeting experience with our Comprehensive Financial Tools. Designed to support every aspect of your financial management, these sheets provide essential resources for effective planning, reflection, goal setting, and smart financial decisions.

Beginner-Friendly Excel Budget Template for Business Owners

Whether you’re running a solo venture, managing a growing team, or just starting your financial journey, this Business Budget Template is designed to support businesses of all sizes and industries.

With structured sheets, automated calculations, and real-time insights, you can plan, track, and analyze your income, expenses, bills, and financial goals confidently throughout the year.

Why Choose This Template?

- Easy to Use: User-friendly layout with intuitive navigation and color-coded cells—no advanced Excel skills needed.

- Advanced Features: Includes dynamic dashboards, monthly and annual summaries, heatmaps, auto-updated charts, and smart bill tracking based on real transactions.

- Customizable & Print-Ready: Personalize categories, departments, projects, and currency. Easily print or export for reports and business presentations.

- Works for Any Year: Set your own budget year and starting month—ideal for both calendar and fiscal year planning.

- All-in-One Financial System: Plan budgets, log transactions, track bills, monitor savings goals, reflect on progress, and manage business tasks—all from one powerful Excel file.

Here’s What You’ll Receive:

Take control of your business finances today with our comprehensive Business Budget Template for Excel:

🧾 Business Budget Template – Blank Version

- Fully Customizable: Set up your own budget year, income, expense categories, departments, and projects tailored to your business structure.

- Complete Financial Management: Track income, expenses, bills, savings, and goals—all in one organized, professionally designed template.

- Clean & Clear Layout: Designed for easy navigation and data entry with color-coded edit zones and smart navigation menus.

📊 Business Budget Template with with Sample Data

- Quick Start: Instantly explore the template using pre-filled sample data that demonstrates real-world business finances.

- Learn by Example: Understand budgeting best practices and how to categorize transactions with ready-to-use examples.

- Effortless Customization: Simply replace the sample data with your actual figures to start managing your business finances right away.

Trusted by 6,500+ users worldwide

Project Managers from the biggest brands in the world choose us for managing their Projects, Tasks and Resources.

Oscar –

The annual summary dashboard lays out revenue, expenses, and profit on one screen, making investor updates painless. Our leadership now reviews financial trends before Monday stand-ups instead of waiting for quarterly reports.

PNRao –

Fantastic that your leaders have real-time insights, Olivia! We designed the summary to facilitate rapid decision making. Watch for our upcoming multi-entity toggle to compare subsidiaries during those Monday discussions.

Lilly –

Department filters instantly reveal which teams overspend travel budgets, sparking productive cost-cutting conversations instead of finger-pointing. The heat map even showed seasonal peaks we never noticed in three years of Quick Books exports.

PNRao –

Glad the departmental insight uncovered hidden travel spikes, Lilly. Our next release will include drill-down comparison charts so you can benchmark each team’s monthly spend against customizable baseline targets automatically.

Natasha –

Switching fiscal year start to April and renaming categories took moments. Everything recalculated flawlessly, proving the template respects non-calendar accounting and saves hours compared to rebuilding pivot tables annually.

PNRao –

Happy fiscal flexibility worked smoothly, Natasha! We’re adding built-in country presets, so future users can activate local tax calendars and statutory categories with a single drop down.

Henry –

Heat map quickly showed weekends of negligible sales, inspiring us to schedule server maintenance those low-impact days. Data visualization drove IT planning unexpectedly.

PNRao –

Love that heatmap guided operational scheduling, Henry! Upcoming threshold alerts will signal exceptionally low or high activity days automatically soon.